Recently, the Washington Department of Labor & Industries issued proposed changes to Washington State’s Overtime Exemption Regulations. The new salary minimum will increase on a graduated scale starting in July 2020. By January 1, 2026, salaries by employers must be an amount not less than 2.5 times the state minimum wage with some exemptions for agriculture, teachers and salespeople. This is in addition to proposed changes in the federal Fair Labor Standards Act (FLSA). The last time Washington state made changes to these rules was in 1976. Because of this, FLSA guidelines, which last changed in 2004, superseded previous state guidelines.

The proposed Washington state rules divides employers into two categories: Employers with 50 or fewer employees and those with more than 50 employees.

Initiative 1433, approved by Washington voters in 2016, requires a statewide minimum wage of $11.00 in 2017, $11.50 in 2018, $12.00 in 2019, and $13.50 in 2020.

Beginning 2021, and each year thereafter, L&I is required to make a cost-of-living adjustment to the minimum wage based on the CPI-W. The CPI-W is Consumer Price Index Urban Wage Earners and clerical workers adjustment for inflation.

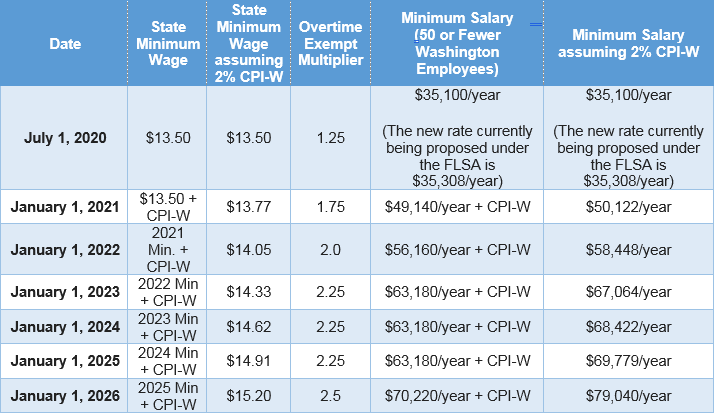

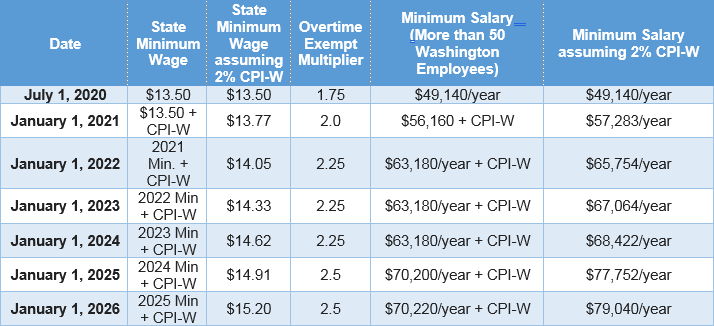

So, what does this really mean? Over the previous 15 years, the CPI-W has increased on average 2% per year. Below are charts showing the effect on proposed Overtime Exempt rules with a 2% increase in the minimum wage starting in 2021.

For the executive, administrative and professional exemptions, the proposed minimum salary basis for employers with 50 Washington Employees or less are:

For the executive, administrative and professional exemptions, the proposed minimum salary basis for employers with more than 50 Washington Employees are:

For the exemption applicable to computer professionals, which both the federal and state laws permit to be paid by the hour instead of via salary, the minimum for employees paid hourly would increase to $37.13/hour, effective July 1, 2020, for employers with more than 50 employees in Washington, rising to $47.25/hour, plus CPI adjustments, for all employers effective January 1, 2022.

The proposed amendments would also amend the duties tests under Washington state law to conform to the federal FLSA duties tests, except that the amendments would continue to leave Washington without a highly compensated employee exemption.

For employers who currently have salaried employee below this threshold, they have two options: Increase their employees’ salaries to the new thresholds or Move these employees to an hourly rate. This may require needing some additional tools to track their time which Time Equipment Company can provide.

To see the entire rule proposal, Click Here.

Employers still have an opportunity to submit public comments or attend a public hearing. For more information on this opportunity, Click Here.