Have you ever wondered what happens when a company changes the days it counts as a workweek? Let’s dive into how this works, especially when calculating overtime using the Fair Labor Standards Act (FLSA) guidelines.

What is a Workweek?

A workweek is a seven-consecutive day period businesses use to track working hours and calculate pay. For example, a workweek might start on a Monday and end on a Sunday. According to FLSA, hourly employees must receive Overtime Pay after more than 40 hours in a workweek at 1.5 times the regular hourly rate.

Changing the Workweek

Sometimes, companies need to change when their workweek starts and ends. This change can create overlapping workweeks, where some hours fall into both the “old” workweek and the “new” workweek. This overlap can make it tricky to calculate potential overtime.

FLSA Guidelines for Overlapping Workweeks

The FLSA has a specific way to handle these overlapping hours to ensure employees get the proper pay. Here’s a simplified explanation of the process based on § 778.302 of the FLSA regulations:

- Calculate pay assuming overlapping hours are part of the old workweek.

- Calculate pay assuming overlapping hours are part of the new workweek.

- Pay the higher amount from the two calculations.

Let’s break it down with an example.

Example: Overtime Calculation with Overlapping Workweeks

A company is changing its workweek from one going from Thursday through Wednesday to one from Sunday through Saturday. Assume also that an employee is paid $20.00/hour. The employee worked the following hours during the period of the workweek change:

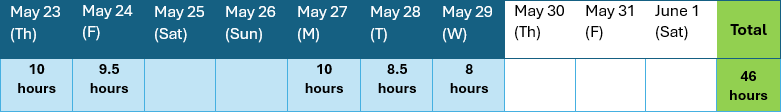

Old Workweek: Thursday-Wednesday

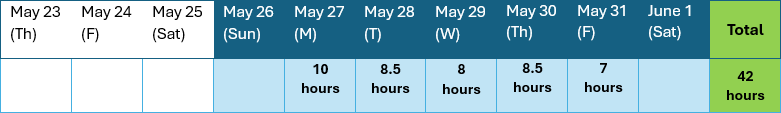

New Workweek: Sunday-Saturday

This employee’s wages would be computed as follows for the overlapping workweek (10-day period in this example):

The 10-day period has a total of 61.5 hours.

Pay for 46 ‘Old’ Workweek hours:

[(40 hrs. × $20.00) + (6 OT hrs. × 1.5 × $20.00)] = $980

Pay for 15.5 ‘New’ Workweek hours:

(15.5 hrs. × $20.00) = $310

TOTAL DUE FOR TEN-DAY PERIOD USING ‘OLD WORKWEEK’ FOR OT:($980 + $310) = $1290

Pay for 42 ‘New’ Workweek hours:

[(40 hrs. × $20.00) + (2 OT hrs. × 1.5 × $20.00)] = $860

Pay for 19.5 ‘Old’ Workweek’s hours:

(19.5 hrs. × $20.00) = $390

TOTAL DUE FOR TEN-DAY PERIOD USING ‘NEW WORKWEEK’ FOR OT:($860 + $390) = $1250

Because the first computation produces a greater figure of $1290, the U.S. Department of Labor’s guidelines call for the employee to be paid this amount for the ten days.

By understanding these calculations and visualizing the overlap, employers can see how employees are fairly paid when workweeks change. The goal is to ensure employees receive correct pay for the hours worked during the transition period.

How We Can Help

As you can see, Overlapping Workweeks can get more complicated. Notifying your time and attendance company, payroll provider, and employment law attorney before changing your workweek is vital to compliance.

Time Equipment Company’s world-class time and attendance solution can help make these calculations after the change in the workweek is completed. All pay adjustments can be made in our system before it goes to payroll. For more information, contact Time Equipment Company at sales@timeequipment.com or 800-997-8463.

*This document simplifies complex Acts as Time Equipment Company understands them. It is not to be taken as legal advice. The regulations for this program are changing. For further information, please visit the U.S. Department of Labor.